Why Every Serious Trader Should Keep a Journal

Trading isn't just about reading charts and placing orders — it's about deliberate practice. You can't improve through repetition alone. Think about it: you've probably used a keyboard for 15 years, but unless you've intentionally practiced typing, you haven't gotten much faster. Trading is no different.

Trading Requires Deliberate Practice

Improvement comes from structured reflection, not just time in front of the screen. It means revisiting your trades, analyzing what worked and what didn't, and noticing patterns — not just in the charts, but in your decisions.

That kind of progress doesn't happen by accident. It happens when you journal.

Memory Fades, But Journals Remain

Every trade starts with a decision — built on chart patterns, market context, conviction, or even hesitation. But unless you write down your reasoning, you'll forget. You might think you'll remember why you entered a trade, but give it a week and it's all fuzzy.

Journaling captures your mindset and your process when it's still clear — and it gives you a record to review later with fresh eyes.

It helps you:

- Remember the real reason you entered a trade

- Spot recurring mistakes

- Track emotional tendencies

- Refine your strategy based on experience, not guesswork

Journaling in Real Time Is Hard

The truth is, your trade data often isn't available until the end of the day or week. That makes journaling hard to do consistently — because by the time you sit down to review, the thoughts and emotions that led to each decision are already fading.

That's why it's important to capture your thoughts as they happen.

Trader Sage makes this easier. Even before your trades are imported, you can jot down your daily thoughts — plans, setups, mindset. Later, once your trades are imported, they line up perfectly with your notes from that day.

We don't solve the delay — but we do make it easier to stay consistent.

A Sample Journal Entry

Here's what a simple entry might look like:

🗓 Date: 2025-04-18

🧠 Pre-market notes:

Market gapping up on strong earnings. Watching NVDA and META for continuation setups.

📊 Plan:

NVDA long on pullback to 20 EMA with confirmation. Avoid chasing.

💬 Mindset:

Slept okay, feeling focused. Avoid overtrading the open.

🔍 Review (added after import):

Took the NVDA trade as planned. Good entry, but exited too early. Left a lot on the table. Review scaling strategies.

Just a few lines a day is enough to surface real insights over time.

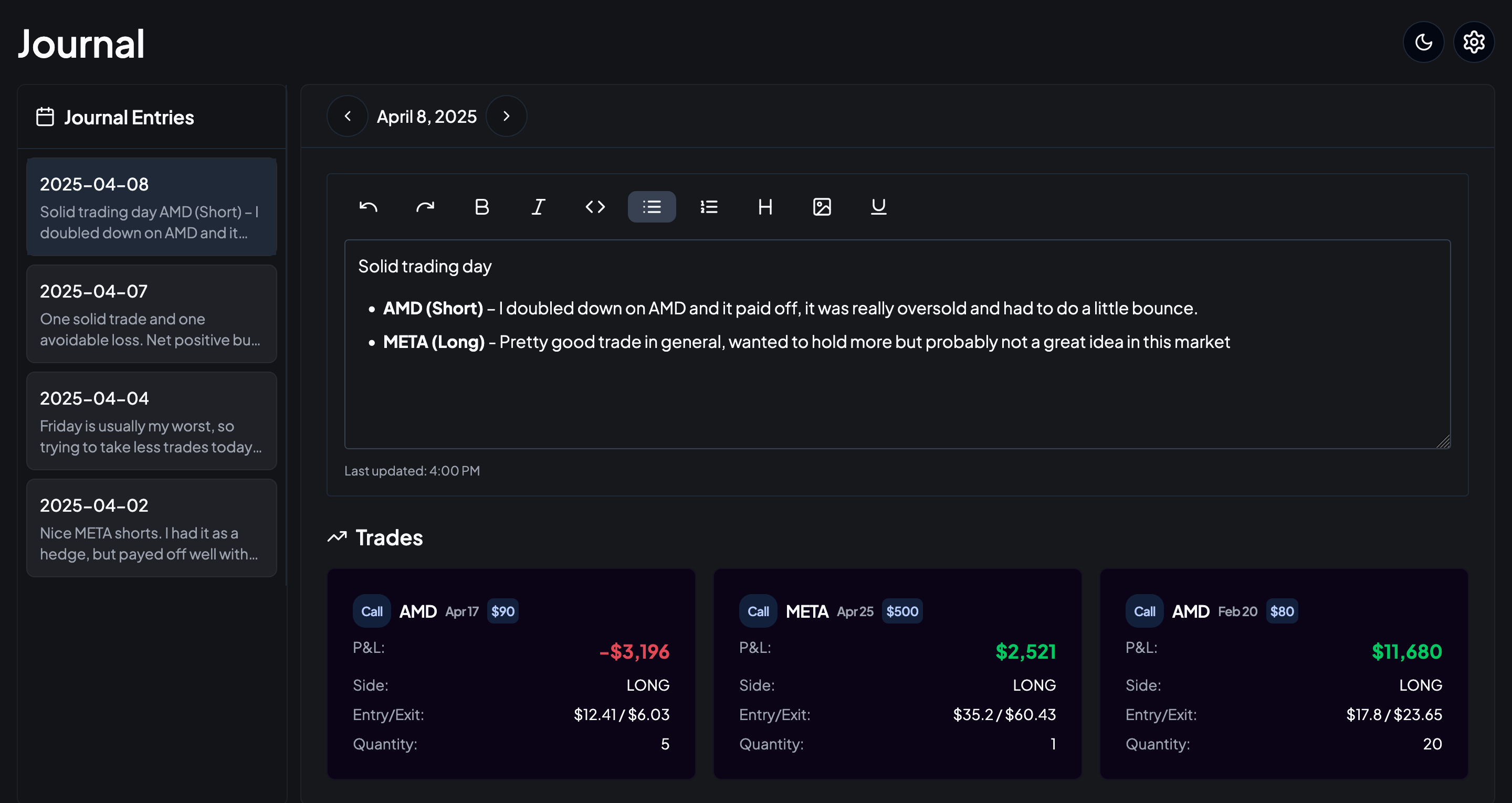

Journaling with Trader Sage

Every journal entry in Trader Sage starts with a simple text area where you can log your daily thoughts. Below that, your trades for the day appear once imported — giving you a clear picture of your plan, your execution, and your results, all in one place.

If you're serious about improving, journaling isn't optional — it's part of the process.